A company is an entity registered under the Companies Act. A company has a legal personality separate from its shareholders. A company can enter into contracts, sue and be sued in its own name.

It can own property in its own name and enjoy the fruits of that property. Shares represent the equity ownership of a company.

When it comes to business, there are many different types of legal entities that a person can choose to form. Each type has its own advantages and disadvantages, so it’s important to understand the differences before making a decision. One type of business entity is a company.

A company is a legal entity that is separate from its owners, and it has certain rights and obligations under the law.

There are several steps that must be taken in order to form a company. First, the owners must choose the type of company they want to form.

There are four main types of companies: sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each type has different rules about ownership, management, and liabilities. Once the owners have decided on the type of company they want to form, they must choose a name for the company and register it with the state government.

They will also need to obtain any necessary licenses or permits required by law.

After the company has been registered and all necessary licenses and permits have been obtained, the next step is to create corporate bylaws. These bylaws will outline how the company will be governed and operated.

Once these bylaws are in place, the final step is to hold an organizational meeting where shareholders can elect directors and officers for the company. After these initial steps have been completed, the new company will be up and running!

Table of Contents

Company Law – Formation of Companies

What Do You Mean by Formation of a Company?

There are many different types of business entities in the United States, but the most common type is the C-corporation. To form a C-corp, a group of people must file articles of incorporation with their state’s secretary of state office. The articles must include the corporation’s name, its purpose, the names and addresses of its directors, and other basic information.

Once the articles are filed, the corporation is officially formed.

The next step is to get an employer identification number from the IRS so that the corporation can open a bank account and start doing business. The corporation will also need to adopt bylaws, which outline how it will be governed, and elect officers such as a president, vice president, treasurer, and secretary.

Stockholders will need to be issued stock certificates. And finally, the corporation will need to obtain any necessary licenses and permits required by federal, state, and local governments.

What are the Steps in the Formation of the Company?

There are many steps involved in the formation of a company. The first step is to choose the type of business entity you want to form. The most common types of business entities are sole proprietorships, partnerships, corporations, and limited liability companies (LLCs).

Each type has its own advantages and disadvantages.

The next step is to choose a name for your business. This name should be unique and should not be confused with any other businesses that may already exist.

You will also need to register this name with your state’s Secretary of State office.

After you have chosen a name and registered it, you will need to obtain the necessary licenses and permits for your business. Depending on the type of business you are forming, this could involve obtaining a sales tax permit, a zoning permit, or other licenses or permits that may be required by your state or local government.

Once you have obtained all the necessary licenses and permits, you will need to find suitable office space or retail space for your business. If you are planning on operating online, you will not need physical space but will still need to obtain a domain name and web hosting services.

Now that you have secured office or retail space and obtained all the necessary licenses and permits, you can start hiring employees!

Before doing so, however, make sure that you have set up payroll accounts with the appropriate federal and state agencies so that withholdings can be taken out of employee paychecks correctly.

What are the Four Types of Company Formation?

There are four types of company formation: sole proprietorship, partnership, limited liability company (LLC), and corporation. Each has its own advantages and disadvantages.

A sole proprietorship is the simplest type of business to start up.

You don’t need to file any paperwork with the government, and you can begin operating your business immediately. The main disadvantage of a sole proprietorship is that you are personally liable for all debts and obligations of the business. If your business fails, creditors can come after your personal assets, such as your home or savings account.

A partnership is similar to a sole proprietorship in that it’s easy to set up and there’s no paperwork required. However, with a partnership there are two or more owners, each of whom is personally liable for the debts and obligations of the business. Partnerships can be either general partnerships or limited partnerships.

In a general partnership, all partners share equally in the profits and losses of the business. In a limited partnership, there are both general partners and limited partners. Limited partners have less control over the business than general partners do, but they also have less personal liability if the business fails.

An LLC is a hybrid between a sole proprietorship/partnership and a corporation. Like a corporation, an LLC offers its owners limited personal liability for debts and obligations incurred by the business. But unlike a corporation, an LLC doesn’t have to pay corporate income taxes—all profits “pass through” to the owners and are taxed at their individual tax rates.

LLCs can be owned by one person or by multiple people (including corporations and other LLCs). One advantage of an LLC over a corporation is that it’s easier to set up—there’s less paperwork involved in forming an LLC than there is in forming a corporation..

A corporation is distinct from all other types of businesses because it offers its shareholders limited liability protection from debts and obligations incurred by the corporation itself—the shareholders’ personal assets are not at risk if the corporation goes bankrupt.. Another advantage of incorporating is that corporations tend to have an easier time raising money from investors than other types businesses do.. However, setting up a corporation requires more paperwork than setting up any other type of business entity..

What is Company And How It is Formed?

A company is an organization that is formed to carry out business activities, commercial or industrial enterprise. Companies may be organized in different ways for different purposes. Some companies are organized to make a profit, while others may be nonprofit organizations.

The word “company” comes from the Latin word “companio,” which means “associate” or “partner.”

In order to form a company, there are certain steps that must be taken. First, the individuals who wish to form the company must come up with a name for the business and register it with the state in which they plan to operate.

Next, the individuals must choose a business structure. There are several types of business structures, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Once the business structure has been chosen, the next step is to obtain any licenses or permits that may be required by state or local law.

Finally, the company must open a bank account and establish credit lines in order to finance its operations.

There are many advantages to forming a company. One advantage is that it can help individuals avoid personal liability for debts incurred by the business.

Another advantage is that it can make it easier to raise capital by selling equity interests in the company. Finally, forming a company can give individuals greater control over how their business is managed and operated.

Credit: www.lawnn.com

Formation of Company in Company Law Pdf

The company is an artificial person created by law. It has a separate legal entity from its members. A company can be formed for any lawful purpose.

The law of a country regulates the formation, registration, incorporation, management and winding up of companies.

There are two main types of companies – private and public. Private companies are owned by a few individuals and have limited liability.

Public companies are owned by many shareholders and have unlimited liability.

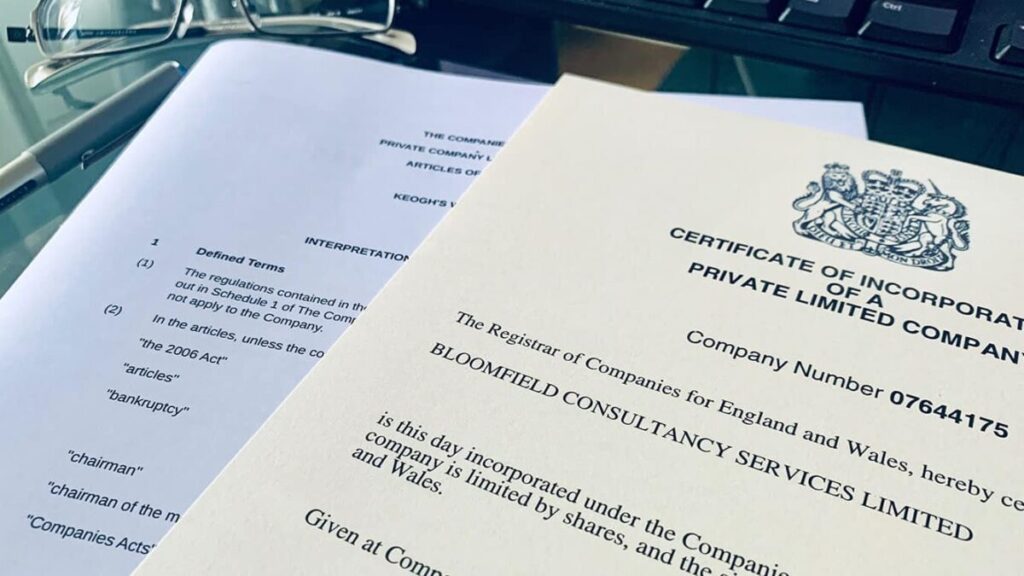

A company must be registered with the Registrar of Companies to obtain a corporate identity number (CIN). This is done by filing the required documents with the Registrar along with the prescribed fee.

After registration, the company becomes a legal entity and can commence business operations.

The key documents required for incorporating a company are:

1) Memorandum of Association (MoA);

2) Articles of Association (AoA);

3) Certificate of Incorporation;

4) Letter of allotment of shares;

5) Share certificate; and

Formation of Company in Company Law Notes

Company law deals with the incorporation of a company, its objectives and powers. The shareholders of a company have certain rights and duties towards the company. A company is an artificial person created by law.

It has a legal identity separate from its members.

Formation of Company in Company Law 2013

When it comes to incorporating a company, there are a few key things you need to know. The first step is to choose the right type of business entity for your needs. There are four main types of business entities in the United States: sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

Each has its own advantages and disadvantages, so it’s important to choose the one that best suits your business.

Once you’ve decided on the type of entity you want to form, the next step is to file the necessary paperwork with your state government. This usually includes filing articles of incorporation or organization, as well as paying any associated fees.

Once your paperwork is in order, you’ll need to obtain any licenses or permits required by your state or local government before you can start doing business.

The final step in forming a company is to create corporate bylaws. These bylaws outline how the company will be governed and provide important information such as the names of the officers, directors, and shareholders.

Bylaws are not required by law, but they are essential for running a smooth and efficient operation. With everything in place, you’re now ready to start doing business!

Formation of Company in Company Law Ppt

The process of incorporating a company in the United States can be daunting, but there are some key steps that can make it much easier. The first step is to choose the state in which you want to incorporate. This is usually the state where your business will be located, but not always.

Once you have chosen a state, you need to select a name for your company and check to see if it’s available. You also need to determine what type of company you want to form- an LLC, sole proprietorship, or corporation. Once you have all this information, you can begin filling out the necessary paperwork with the state.

After your paperwork is filed, you will need to obtain an Employer Identification Number from the IRS. You will also need to open a bank account in your company’s name and get any licenses or permits that may be required for your business. Finally, you should draft bylaws or operating agreements which will outline how your company will be run.

Incorporating your business can seem like a lot of work, but following these steps will make it much simpler.

Requirements for the Formation of a Company

There are several requirements for the formation of a company. First, the company must have a name. This name must be registered with the state in which the company is formed.

The company must also have a board of directors, which must be composed of at least three individuals. The board of directors is responsible for overseeing the management and operations of the company. Finally, the company must have bylaws, which outline the rules and regulations governing the operation of the business.

Formation of Company in Company Law Slideshare

Are you thinking about starting a company? Or are you already in the process of forming one? If so, you’ll need to know about company law.

This area of law governs the formation and operation of companies. It’s important to understand the basics of company law before you get started, so that you can ensure that your company is properly formed and operated.

The first step in forming a company is to choose the type of entity that you want to create.

The most common types of business entities are sole proprietorships, partnerships, limited liability companies (LLCs), and corporations. Each type has its own advantages and disadvantages, so it’s important to choose the right one for your business. Once you’ve selected the type of entity, you’ll need to file the appropriate paperwork with your state or local government.

After your entity has been created, there are a number of other legal issues that you’ll need to address, such as getting licenses and permits, complying with environmental regulations, and managing employee relations. Company law can be complex, but it doesn’t have to be overwhelming. By taking some time to learn about the basics, you can ensure that your company is properly formed and operated from the start.

Formation of a Company Notes

When it comes to the formation of a company, there are a few key things to keep in mind. First and foremost, you’ll need to choose the right business structure for your new company. This will determine the legal liability of the owners, as well as how taxes are paid.

There are four main types of business structures: sole proprietorship, partnership, limited liability company (LLC), and corporation. Each has its own advantages and disadvantages, so be sure to do your research before making a decision.

Once you’ve chosen your business structure, you’ll need to obtain the necessary licenses and permits from your state or local government.

This can be a lengthy and complex process, so again, be sure to do your homework beforehand.

Finally, you’ll need to open a business bank account and get insurance for your new company. Once all of these steps are complete, you’ll be ready to start doing business!

Incorporation Meaning in Company Law

Incorporation is the process of creating a legal entity for a business. This gives the business certain legal rights and protections, such as the right to enter into contracts and to own property. Incorporation also makes it easier to raise capital by selling shares in the company.

There are several different types of incorporation, but the most common in the United States is called a C corporation. In order to form a C corporation, you must file articles of incorporation with your state’s secretary of state. You will also need to create bylaws that outline how the corporation will be governed, and elect a board of directors.

Once you have incorporated your business, you will need to obtain licenses and permits from your local government in order to operate legally. You will also need to comply with all applicable tax laws. Failure to do so could result in fines or even criminal charges.

Incorporating your business can be a complex process, but it is well worth it if you want to enjoy the many benefits that come with owning a corporation.

Conclusion

The process of incorporating a company requires the filing of certain documents with the state government. The most important document is the articles of incorporation, which must be filed with the secretary of state. The articles of incorporation must contain the following information:

1) The name of the corporation;

2) The address of the corporation’s principal office;

3) The names and addresses of the corporation’s directors;

4) The purpose or purposes for which the corporation is organized; and

5) The number of shares of stock that the corporation is authorized to issue.

In addition to filing the articles of incorporation, you will also need to adopt bylaws, which set forth the rules and regulations governing the internal affairs of your corporation.

You will also need to elect a board of directors, who will oversee the management of your company. Once you have completed these steps, you will be ready to do business!